ThrivacaCORE™:

A single actuarial engine that powers two massive markets

ArxNimbus ThrivacaCORE™ is the only NIST-aligned, actuarial cyber exposure platform trusted by both insurers and enterprises — delivering defensible financial truth, not opinions or estimates.

- Actuarial-grade differentiation:

probabilities, loss modeling, ROI — not compliance scores - Validated at the highest levels:

NIST-aligned, DoD-sponsored, MITRE + University of Chicago - Built to scale:

expanding from a validated insurance revenue foundation into enterprise exposure quantification

It's not magic, it's math!

Compliance. Budget Optimization. Clarity. Minimized Exposure

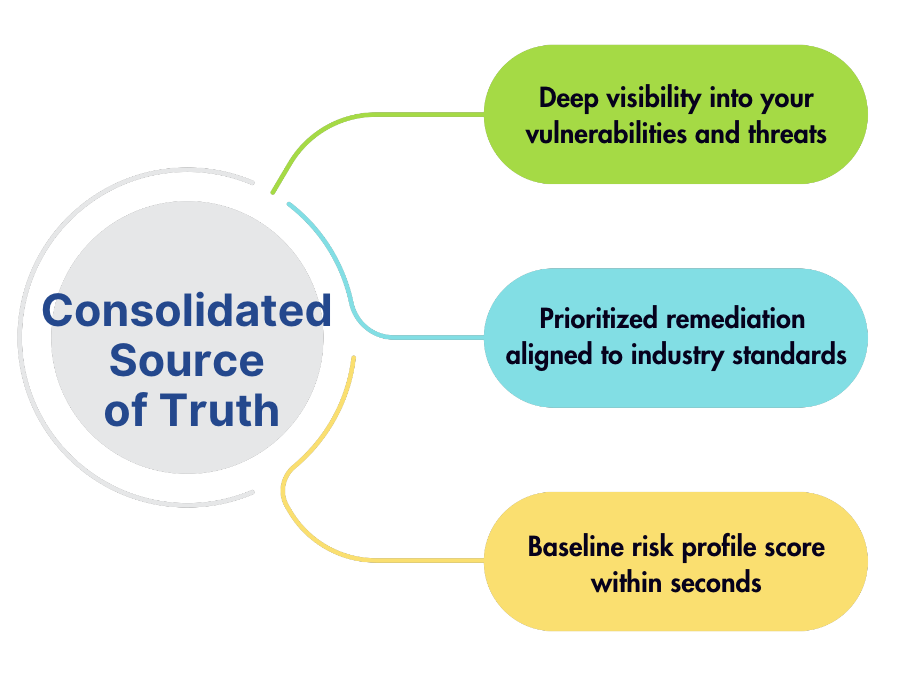

Organizations worldwide are navigating an increasingly complex cybersecurity landscape. With ArxNimbus Thrivaca, you get a consolidated source of truth for identifying risk and optimizing cyber investments.

- See what you’ve been missing: Thrivaca provides deep visibility into your organization’s vulnerabilities, threats, and overall digital risk.

- Protect your enterprise: Prioritize remediation efforts that align with industry standards, including NIST and MITRE ATT&CK, and improve your resilience to cyberattacks.

- Get results fast: Obtain a standards-based baseline risk profile within seconds, giving you the insights needed to take action.

Digital risk intel

Non-invasive IP scans and ICS/IoT and CVE details provide an in-depth analysis of an organization's risk-attribute data, including specific vulnerabilities and threat exposures - real-time results in seconds

50+ integrations

Integrates with dozens of widely-used cybersecurity solutions, providing an end-to-end automated set of comprehensive results - powered by AI-enabled processes and backtested to establish advanced scoring

Multi-level visualizations

A multi-data source actuarial process provides a comprehensive understanding of digital risk and top sources of loss exposure; Probable Maximum Loss (PML) derived across eight critical cyber risk types

Standards-compliant valuation

NIST-driven quantitative analysis is the most compliant and defendable basis for a cybersecurity program, recognized by Gartner, NIST and the DoD; meets or exceeds the latest requirements of NIST, MITRE ATT&CK, FFIEC, HHS/OCR, GDPR, ISO, NY DFS

Real-time benchmarking

Leveraging thousands of profiles across industry (NAICS code), revenue size, and industry+revenue to unlock significant advantages, from operational insights to regulatory compliance

Real-time monitoring

Ongoing monitoring of your risk profile with updated threat trends, vulnerability identification, and updated loss pattern analysis

Gap analysis

Today's cybersecurity already eliminates many risks. Yet even with conventional cybersecurity, gaps remain. Find out where they are, their root causes, what they're costing you, and how to solve them

Enhanced decision-making

Integrating technology decisions and business strategies is essential to get optimal business/financial metrics, gain proper funding for cyber strategies, and provide business-relevant results

SITUATION

A $170 billion global corporation was struggling to gain clear insights into its risk management despite a $300,000 investment.

The results of a series of workshops and interviews were largely subjective and failed to offer actionable intelligence, leaving the company exposed and unclear about its true risks.

SOLUTION

Enter ArxNimbus’ Thrivaca™ Data-Driven Risk Management solution.

This platform transformed the company’s approach by introducing external threat scans, economist-validated risk valuations, and financial data integration, all tied to real-world numbers and regulator-approved frameworks.

IMPACT

- Quantified Risk Exposure: The company measured risk in dollar terms, uncovering that its previous assessments underestimated critical risks by up to 89%.

- Actionable Insights: Adjustments in cyber threat preparedness became possible with data-backed insights on potential ransomware losses and unfunded liabilities.

- Enhanced Cybersecurity Investments: With a clear view of the financial implications, the organization reevaluated its cybersecurity strategy, ensuring efficient allocation of resources.

SITUATION

A $2.8 billion financial services firm faced uncertainty in its cybersecurity strategy despite a $24 million budget.

Without a clear priority framework, concrete risk assessments, or a valuation of unfunded liabilities, the firm's digital defenses were scattered and opinion-driven.

SOLUTION

Leveraging ArxNimbus’ Thrivaca™ Risk Management Platform, the firm established a baseline risk profile, quantifying its digital risk and providing a robust valuation framework with an enterprise-wide scope.

IMPACT

- Accurate Risk Projections: Initial estimates of $75 million in digital risk ballooned to $381 million with the Thrivaca platform’s precise calculations.

- Prioritized Risk Mitigation: The firm could now prioritize its cybersecurity investments, focusing on high-impact areas and saving $25 million in the first year alone.

- Strategic Decision-Making: With clear risk tolerance levels, the firm aligned its cybersecurity efforts more strategically, making informed decisions about risk acceptance, mitigation, and transfer.

SITUATION

Ensono, a leading cloud services provider, had spent $250,000 on a consulting firm for a cyber risk assessment but received imbalanced results mixing subjective and objective data, leaving the company with unclear risk insights.

SOLUTION

Switching to ArxNimbus’ Thrivaca™ risk management platform, Ensono received real-time, data-driven insights into its cyber risks, offering a transparent view of its risk landscape.

IMPACT

- Swift Insights: Within days, Thrivaca provided actionable intelligence, a stark contrast to the prolonged results of the previous assessment.

- Informed Decision-Making: The platform’s comprehensive risk data enabled Ensono to take targeted, effective action.

- Cost Efficiency: Thrivaca’s immediate insights potentially saved Ensono the $250,000 consulting fee they had previously spent.

Integrations

Risk management results expand as more meaningful data becomes integrated into our ACRQ actuarial analysis. Every organization has its' own mix of internal and external data available, including data on vulnerabilities (e.g "CVEs"), and data on threats. In addition, many Thrivaca users seek to consolidate their risk results with other key indicators.

For these goals, we also provide an output API for expressing data to Splunk, Snowflake, and other environments.

FEATURED FREE RESOURCE

7 tips to optimize your cyber insurance decisions

Here’s a strategic approach to securing a policy that adequately covers potential risks and minimizes gaps. It also emphasizes understanding payout requirements.

STAY AHEAD OF CYBER THREATS

Access to our monthly LIVE ‘RISK CALL’ & ‘CYBERWatch News’

From live sessions with industry leaders to timely, subscriber-only reports on the latest trends, you'll have everything you need —reliably sourced and digestible summaries —to safeguard your assets, reputation, and bottom line.

Don’t miss out on the tools that give you a competitive edge in managing and mitigating cyber risks.